Hoymiles Inverter’s 2024 Half-Year Performance Declines

On August 28, Hoymiles Inverter Co., Ltd. (SH:688032) released its 2024 half-year financial report, revealing a drop in performance across key metrics. The company reported a revenue of 908 million RMB, down 14.78% year-on-year.

Net profit attributable to shareholders decreased by 46.16% to 188 million RMB, while the net profit after deducting non-recurring items fell by 44.37% to 185 million RMB. This marks the lowest net profit for the company in nearly three years.

Challenges Facing the Company

Hoymiles attributes the decline in performance to the overall challenging environment in the photovoltaic and energy storage industries, resulting in slower sales growth during the reporting period.

It’s stock has also suffered significantly, falling by 60% from its peak of 301.53 RMB in January 2024 to 120.52 RMB by August 28. As of the latest close, Hoymiles’ total market value stands at 14.92 billion RMB.

Sales and Market Trends

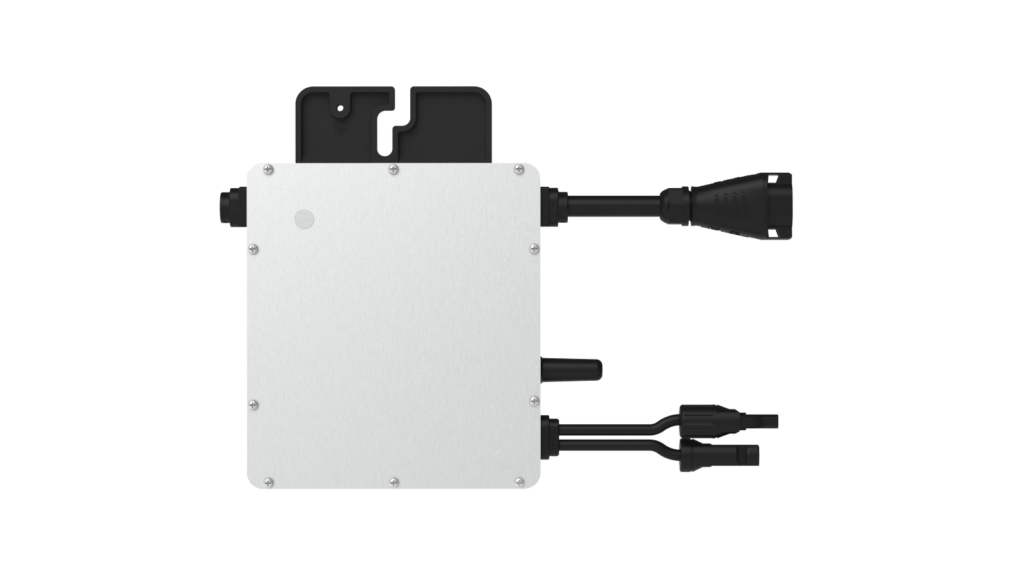

Hoymiles, established in 2012 and listed on the STAR Market in December 2021, specializes in the research, development, manufacturing, and sales of photovoltaic inverters and energy storage products.

For the first half of 2024, the company achieved sales revenue of 749 million RMB from microinverters and monitoring devices. The sales volume of microinverters reached approximately 614,200 units, while monitoring devices sold about 144,400 units.

Despite a 30% drop in microinverter shipments, the company’s performance is deemed in line with expectations.

Hoymiles microinverter sales are projected to see steady growth throughout the year, driven by the implementation of the 800W policy in Germany and reduced interest rates in Brazil.

In 2024 includes a total shipment of 1.5 to 1.7 million microinverters, reflecting a year-on-year increase of over 20%.

Energy Storage Sector Growth

Hoymiles’ energy storage systems achieved a revenue of 137 million RMB in the first half of 2024, a 60% increase from the previous year. The gross margin for these systems stands at around 17%, with expected improvements in profitability in the second half of the year.

They anticipates a doubling of revenue in the energy storage segment to 500-600 million RMB for the full year. Additionally, Hoymiles is expanding its efforts in household and micro-storage markets, with significant growth expected starting in 2025.

International Expansion and R&D Investment

In the first half of 2024, Hoymiles participated in 12 major international trade shows and held over 30 product roadshows targeting key markets.

Hoymiles inverter established sales subsidiaries in the Netherlands, Australia, and the United States, enhancing its global strategy.

They increased its R&D investment, spending 121 million RMB in the first half of the year, a 39.47% increase from the same period last year. This investment focuses on hardware and software advancements, with a continued emphasis on innovation and product development.

As of the end of the reporting period, Hoymiles holds 306 authorized intellectual properties, including 37 invention patents, 21 utility model patents, 13 design patents, and 84 software copyrights. The company added 81 new intellectual properties during the half-year period.