Impact of South African Market Decline on Deye Inverter

Due to decreased demand in the South African market, Deye Inverter (605117.SH) has experienced reductions in revenue, net profit, and adjusted net profit. On August 26, Deye released its half-year performance report for 2024, showing a revenue of 4.748 billion yuan, a 2.97% year-on-year decline. Net profit attributable to shareholders was 1.236 billion yuan, down 2.21%, while the adjusted net profit fell by 16.19% to 1.162 billion yuan. Compared to the previous year, both revenue and net profit have slightly decreased. However, the company expects a record high in shipments for the second half of the year.

Optimistic Outlook from Emerging Markets

On August 27, emerging market demand recovery led to a positive outlook for Deye Inverter’s Q2 performance, which grew despite overall market trends. With adjustments in inverter shipment structures, the company anticipates significant growth in shipments for the latter half of the year. The rapid expansion of the energy storage battery business and increased storage ratio further support this positive outlook.

Company Background and Product Range

Founded in Zhejiang in 2000 and listed on the Shanghai Stock Exchange on April 20, 2021, Deye Inverter offers a comprehensive range of products including energy storage, string inverters, and microinverters. It is one of the few companies in the industry to achieve collaborative growth across these three product categories, with household energy storage inverters being a particular strength.

Decline in Inverter Business Due to South African Market

In the first half of the year, Deye Inverter’s business reported a revenue of 2.322 billion yuan, a 26.06% decrease. The company’s inverter products are primarily sold to countries such as Pakistan, Germany, Brazil, India, and South Africa. During this period, the company sold 711,700 units, including 214,100 energy storage inverters, 242,700 micro-grid inverters, and 254,900 string inverters. Despite a strong market presence in South Africa and significant growth in energy storage inverter sales last year, this year’s demand decline due to reduced power shortages, increased competition, and higher market inventory has affected sales.

Growth in Emerging Markets and Strategic Adjustments

Emerging markets like Pakistan, India, the Philippines, and Myanmar have demonstrated strong demand due to severe power shortages and rising electricity prices. Deye Inverter’s earlier strategic focus on these markets has partially offset the decline in South Africa. The company’s R&D department has collaborated with upstream suppliers to establish a third-generation semiconductor joint laboratory and optimize production processes, enhancing product performance and accelerating updates.

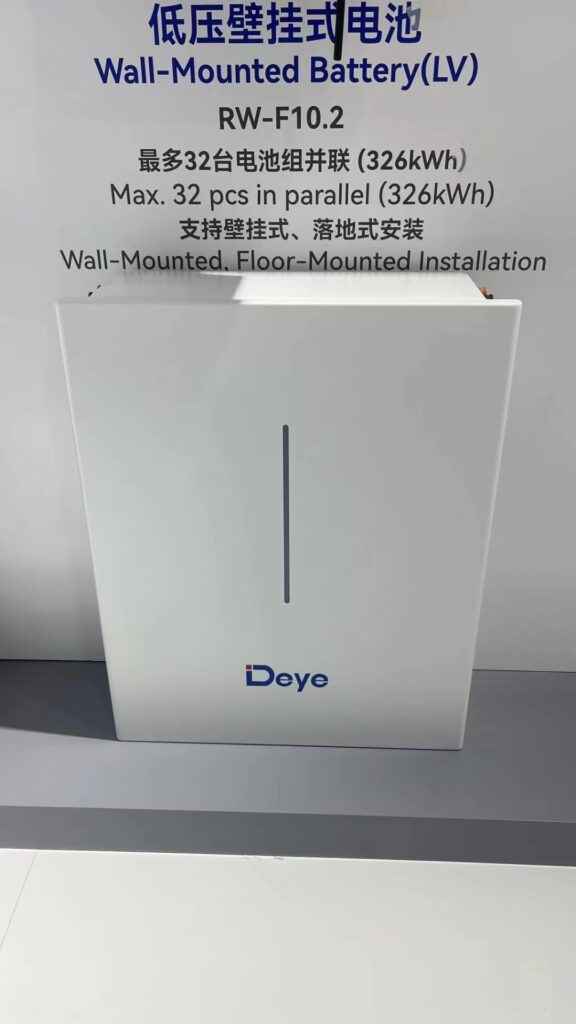

Significant Growth in Energy Storage Battery Business

Deye Inverter’s energy storage battery business saw a remarkable 74.82% increase in revenue, reaching 765 million yuan in the first half of the year. The company’s batteries, known for their high integration, safety, and long cycle life, benefit from rising global demand and integration with the company’s inverter sales channels.

Performance of Other Business Segments

Deye’s heat exchanger business grew by 16.73%, achieving 1.056 billion yuan in revenue, while the dehumidifier business increased by 31.98%, reaching 454 million yuan. As of August 27, Deye Inverter’s stock price was 87.34 yuan, a decline of 0.16 yuan, representing a 17% decrease from the peak of 104.79 yuan on July 25. The company’s total market capitalization stands at 55.733 billion yuan.